If you’re running an eCommerce store, then you need to do more than accept payments. You must ensure that you’re taking payments securely. In an age when there is an increasing number of cyberattacks and data breaches, it’s more important than ever that your customers’ data -- not to mention your data -- is processed, stored, and managed in a safe and secure way. The good news is that, in recent years, great strides have been made in this area.

You can generally rest assured that if you’re using a major company to process your payments, you’ll benefit from the latest and most advanced security systems. However, it’s always worthwhile digging a little deeper to make sure.

In this article, we’ll take a closer look at Stripe and specifically how it interacts with WooCommerce. Does it provide a secure space to process credit card payments? The answer is yes, it does; it’s about as secure as payment can be.

That’s because Stripe has a host of features that bolster security. For instance, when you use the Stripe plugin for WooCommerce, you’ll get the advantage of:

- Achieving PCI compliance

- Having Strong Customer Authentication (SCA)

- Having Stripe Radar and 3D Secure, which helps to detect and prevent fraud

- Receiving free updates, so your system is always in line with the latest security technology, measures and protocols.

What is StripeJS?

Another advantage of using Stripe with WooCommerce is that it uses StripeJS. This is a form that you’ll need to add to your system, but it’s worthwhile doing so. When a customer submits their credit card details into the form, the information will go directly to Stripe’s servers. They’ll never be on your servers, thus reducing your culpability.

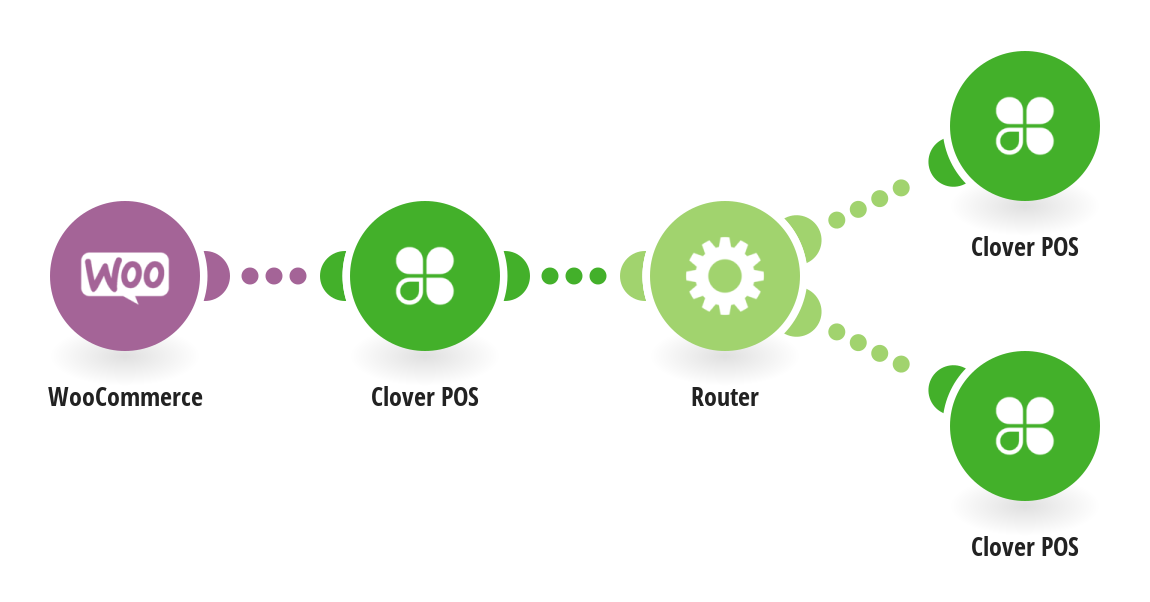

What is Stripe Connect?

Stripe Connect is a quick and easy way to integrate payments into your website. Not only is it extremely intuitive to use, but it’s also highly flexible; you’ll be able to customize it as you like. It allows you to stay secure regardless of where you’re accepting money. For instance, it accepts payments in more than 135 currencies across the globe. It’s extremely useful for businesses that operate in multiple countries because, rather than following the security measures of each country, Stripe handles everything.

What is card tokenisation?

The less confidential information, the better. Stripe uses tokenisation, which essentially takes personally identifiable information -- as well as other details -- and transforms it into a “token”, which simply represents this information. That way, if you did experience a data breach, then the hackers would be unlikely to see anything of any value. All they’d see were “tokens” that, from their end, would mean nothing at all.

How does this tie into PCI compliance?

It’s highly important that companies that accept credit card payments do so in a PCI compliant way. When you use Stripe, you’ll be PCI compliant -- it’s just that the burden of the compliance will be on Stripe rather than on your company. It keeps your business financially secure without having to do the work yourself.