When operating your online store there are a lot of things you need to take into account in order to make sure things run smoothly. You need to take care of your inventory, payment and shipping, product management, and much more. One of the most unpleasant tasks, however, is managing taxes on your WooComerce store.

Your taxes are associated with a lot of regulations and government rules. This is why, today we have prepared a step-by-step guide, walking you through the process of how to understand your taxes, manage them properly, and even automating the process.

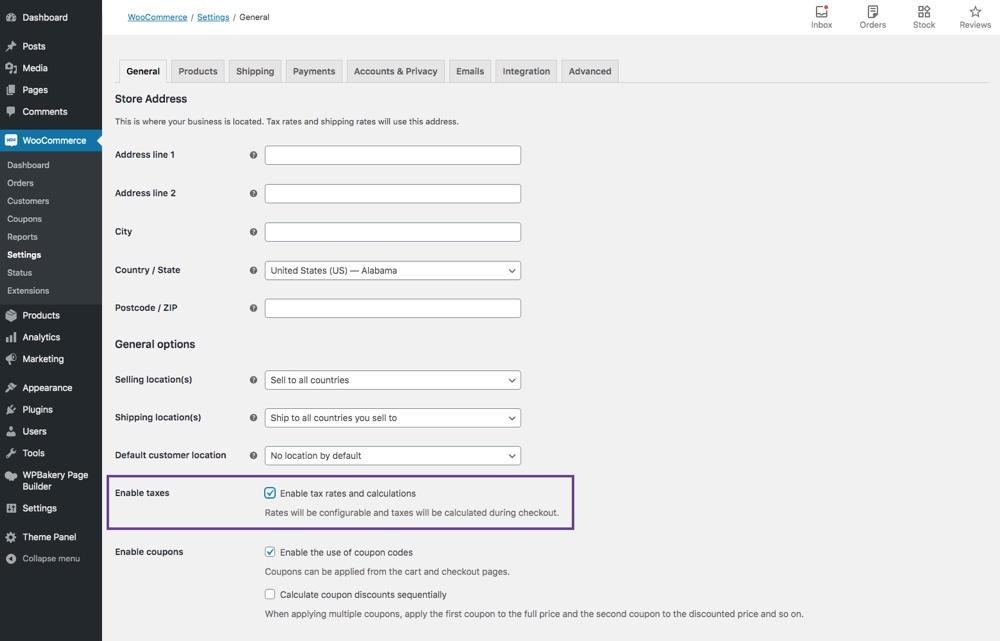

Tax settings on WooCommerce

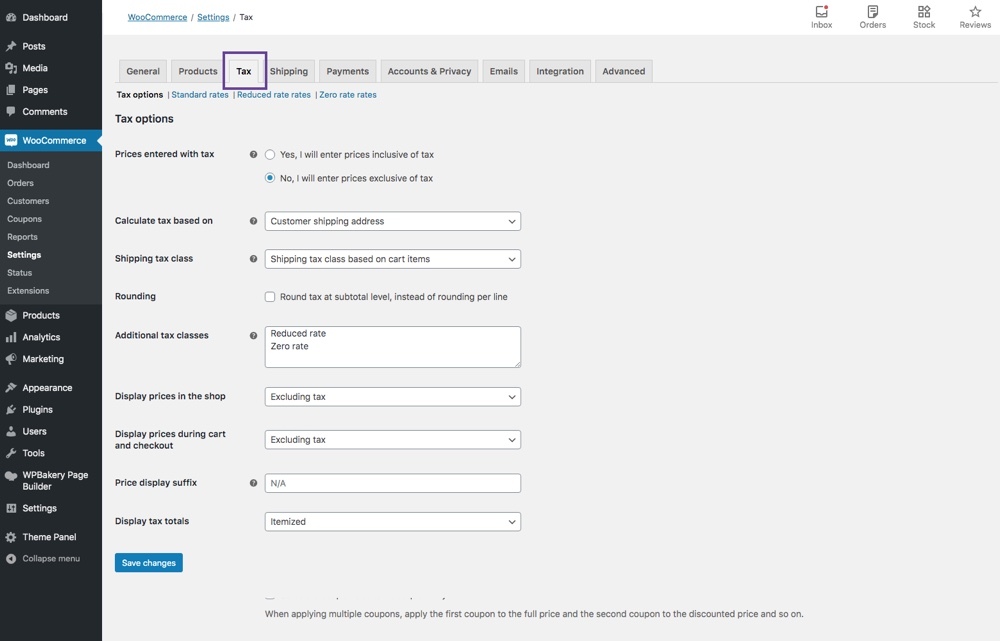

WooCommerce provides a very straightforward guide to help you set up taxes in your online store. The first thing you need to do is enable the tax rates option in general settings. Click on WooCoomerce – Settings – Tax and make the configurations on your e-commerce store.

You are provided with multiple options if you wish to add taxes to your price, additional classes, shipping class, and much more. With WooCommerce you can calculate your taxes in three different ways, such as customers billing location, store location, or the customers shipping location. You also have the option to assign classes to your products, so that every time a customer purchases a product, and additional or standard tax class is applied to it.

You can enable tax prices on your product page, card page, or in the checkout. There are also a lot of settings available for Setting up tax rates as well as how to update or remove them.

How to automate the tax process?

There are a lot of sales tax plug-ins available on the market which will help you to automate the whole process and save you some valuable time.

Below you can see a list of the best WooCommerce plugins which will help you collect and return taxes easily. A lot of businesses have converted to using these plugins which helps them to automate the whole process.

TaxJar

This is the ultimate sales tax plugin. It’s streamlines in order to automate the whole process and makes it very easy to collect or file your taxes. You can easily connect it to WooCommerce and it will automatically calculate taxes based on the sales threshold and customer location. It can also automatically file your taxes so that you do not miss a deadline ever again.

• Maintains 99.99% uptime • Calculate taxes automatically when connected with the TaxJar API • Return taxes automatically • Saves time and effort with AI-driven tax categorization • The Economic Nexus Insights dashboard gives you insights regarding existing nexus, approaching nexus, and more • Detailed reports regarding sales tax

Simple sales tax

This plugin significantly simplifies the whole process with the help of TaxCloud. This is a cloud-based service which helps you keep track of all updated rules and regulations, so that you completely eradicate the chances of errors. The plug-in has a lot of features such as tax reports, real-time tax calculation, tax exemption, and more.

• Easy set up with the help of an installation guide • Detailed tax reports which can be exported • Calculating real-time taxes • Sales tax filed automatically within 24 hours • On-time update of all rules and regulations reducing the risks of errors

WooCommerce Taxamo

This plugin enables you to connect your store with its API which in turn automatically calculates the tax based on your customers location as well as the items in their cart. It provides an EU you VAT calculation which is extremely easy to use.

• EU VAT calculation service • Calculates taxes for all digital and downloadable products depending on the customers’ location and the purchased items • Payments are collected at MOSS (Mini One Stop Shop) registered in the EU.

WooCommerce Tax Exempt

WooCommerce Tax Exempt enables you to exempt taxes from certain clients from the backend. They can fill out a request for tax exemption which can be easily reviewed and you can decide whether to accept or reject it. You can also choose customers for tax exemption without the need to fill out a request form. The tax exemption button can be added on the checkout page. Other features include:

• Creating a request form for tax exemption for users to fill • Admins can approve/reject the tax exemption requests • Customers can follow the status of their request on the “My Account” page • You can choose certain customers and user roles for tax exemptions • Set an expiration date on tax exemption

Avalara AvaTax

This fully automated text experience provides amazing features which can be applied to your ecommerce store.

• Calculate taxes depending on product, location, prices, etc. • Assess your tax rates based on geolocation • Detailed reports about sales tax, tax exemptions, and much more. • Cloud-based service and support of multiple channels.

Conclusion

Managing your taxes for your WooCommerce store is a difficult process which requires professional work. This however, will not entirely eliminate the risk of errors. The rules regarding sales tax are ever-changing and complicated. This is why, with the help of sales tax plugins you can automate the whole process and collect the right taxes and file returns without missing important deadlines.